Best Company to Invest Your Money Guidelines for Evaluating Stocks and Financial Strength, investing in the stock market can be a lucrative endeavor, but it comes with its fair share of risks. One of the keys to successful stock market investing is choosing the right companies to invest in. In this comprehensive guide, we’ll explore guidelines for evaluating stocks for investment, delve into financial strength assessment in companies, and provide you with best company to invest money guidelines along with valuable stock market investment tips.

Table of Contents

The Importance of Company Evaluation

Before delving into the guidelines for evaluating stocks, it’s crucial to understand why assessing a company’s financial strength matters. When you invest in a company’s stock, you become a shareholder, which means you have a stake in the company’s success or failure. Here’s why evaluating a company’s financial strength is essential:

- Risk Mitigation: Assessing financial strength helps you identify companies that are less likely to face financial difficulties, reducing your investment risk.

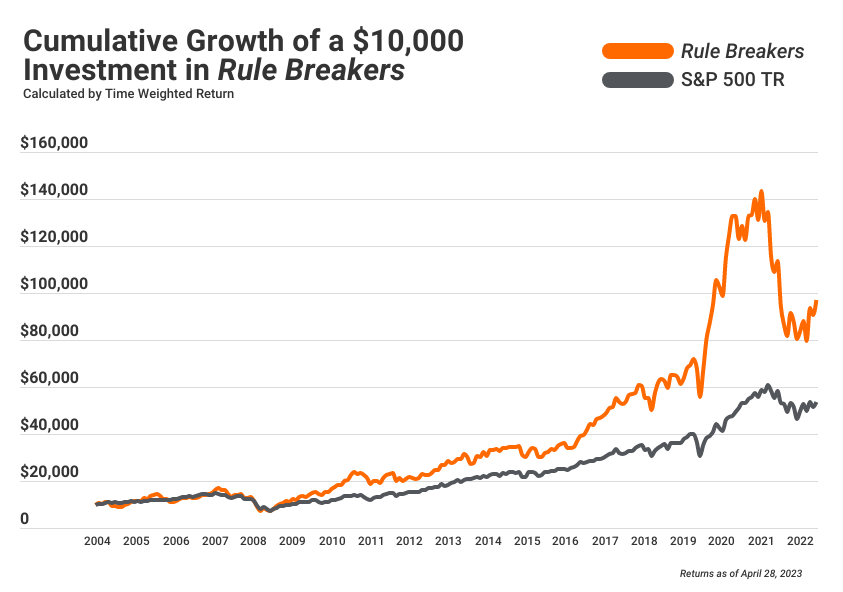

- Profit Potential: Strong companies are more likely to generate profits, potentially leading to higher stock prices and dividend payouts.

- Long-Term Growth: Investing in financially sound companies can result in long-term capital appreciation, creating wealth over time.

Guidelines for Evaluating Stocks for Investment

1. Financial Statements Analysis

Balance Sheet Examination

Review the company’s balance sheet to assess its assets, liabilities, and shareholders’ equity. Look for a healthy balance between assets and liabilities.

Income Statement Analysis

Examine the income statement to gauge the company’s revenue, expenses, and profitability. Check for consistent revenue growth and healthy profit margins.

Cash Flow Assessment

Evaluate the company’s cash flow statement to understand its cash generation and liquidity. Positive operating cash flow is a positive sign.

2. Debt Levels

Debt-to-Equity Ratio

Calculate the debt-to-equity ratio to measure the company’s leverage. A lower ratio indicates lower financial risk.

3. Profitability Metrics

Return on Equity (ROE)

ROE measures the company’s profitability in relation to shareholders’ equity. A higher ROE indicates efficient use of equity.

Earnings Per Share (EPS)

EPS reflects the company’s profitability on a per-share basis. Look for consistent or growing EPS.

4. Dividend History

Dividend Payments

If you’re interested in income investing, review the company’s dividend history. Consistent or growing dividend payments are favorable.

5. Market Position and Competition

Market Share

Assess the company’s market share and its competitive position within the industry. A leading market position can indicate strength.

Competitive Advantages

Identify any competitive advantages the company holds, such as patented technology or strong brand recognition.

Financial Strength Assessment in Companies

1. Credit Ratings

Credit Rating Agencies

Consult credit rating agencies like Moody’s or Standard & Poor’s for credit ratings of the company. Higher ratings indicate lower credit risk.

2. Debt Management

Debt Repayment History

Analyze the company’s history of repaying debt. Consistent debt repayment is a positive sign.

Interest Coverage Ratio

Evaluate the company’s ability to cover interest expenses with its earnings. A higher ratio is favorable.

Best Company to Invest Money Guidelines

1. Diversification

Portfolio Diversification

Spread your investments across different companies and industries to reduce risk.

2. Long-Term Focus

Patience

Invest with a long-term perspective. Short-term market fluctuations should not deter your investment strategy.

3. Risk Tolerance

Assess Your Risk Tolerance

Understand your risk tolerance and invest accordingly. Avoid investments that keep you up at night.

4. Professional Advice

Seek Professional Guidance

Consider consulting a financial advisor or investment professional for personalized advice.

Stock Market Investment Tips

1. Stay Informed

Market Research

Stay informed about market trends, news, and economic indicators that can impact stock prices.

2. Avoid Emotional Decisions

Emotionless Investing

Avoid making investment decisions based on fear or greed. Stick to your strategy.

3. Regular Review

Portfolio Review

Regularly review your investment portfolio and make adjustments as needed.

4. Leverage Technology

Utilize Investment Tools

Take advantage of investment tools and technology to access real-time data and analysis.

Conclusion: Best Company to Invest Your Money Guidelines for Evaluating Stocks and Financial Strength

In conclusion, choosing the best company to invest your money requires diligent evaluation of stocks and an understanding of financial strength assessment in companies. By following the best company to invest money guidelines and stock market investment tips, you can make informed investment decisions that align with your financial goals and risk tolerance. Remember that investing in the stock market carries risks, and it’s essential to conduct thorough research and seek professional advice when necessary. With a well-informed approach, you can increase your chances of achieving long-term investment success.

More Stories

The Secrets of 7 Content Marketing for B2B Companies

Unlocking the Secrets of 9 Social Media Advertising ROI

Mastering the Art of Email Marketing Conversion: 11 Expert Tips